About West Community Credit Union

Cooperative banking is better banking

Founded by Smart Civic leaders

West Community Credit Union began in 1936 as Brentwood Mutual Credit Union. We were founded by 15 business and civic leaders with $150 in capital.

Today West Community is a progressive financial institution with over $469 million in assets, 32,700 members, over $403 million in loans, and branches throughout the STL region. Cooperation works!

Early History

On June 5, 1936, 15 civic and business leaders met in the brand new Brentwood City Hall and founded Brentwood Mutual Credit Union. Their goal was to take charge of their desire for access to fair loans and honest banking for Brentwood's residents. This proved very popular with Brentwood's population and the need for more space inspired a move into our first home inside Bley Eichler’s Barber Shop (really!) where we stayed until 1956. Continued growth lead to a move to 2234 Brentwood Blvd. inside the Jordan Real Estate Office. In 1978 we purchased our first property at 2345 Brentwood Blvd. where we still have a branch today.

In 1986 Brentwood Mutual Credit Union became community based which significantly expanded the number of people we were able to serve. At this point, we changed our name to West Community Credit Union.

Growing Strong with The Greater Saint Louis Region

Our growth has been powered by a desire to serve our members, and strengthen the Credit Union movement. Throughout the years, we have partnered with other credit unions to combine our strengths and offer our members better loan and deposit rates, fewer fees, the latest in digital banking technology, and more support for our communities and local charities.

Inspired by continued growth, we moved our headquarters to O’Fallon, MO in 2004, opening a second branch. We merged with Kirkwood Municipal Credit Union in 2009 and opened our third branch in Kirkwood's Woodbine Center to serve our expanded membership. In 2017 we built a fourth location in Lake St. Louis to serve our members further west. Late in 2017, we merged with Apex Federal Credit Union, adding branches in Florissant and inside the Robert A. Young Building in downtown St. Louis. In 2023, we joined forces with Missouri Valley Federal Credit Union, adding our seventh Saint Louis area branch in St. Peters, MO.

Serving Columbia, MO

In 2006, we embarked on a partnership with Tigers Community Credit Union on the campus of the University of Missouri-Columbia. To serve the wider Columbia community, we opened our second Tigers Community location in early 2016, and in 2022 we built and opened our third branch.

Today we operate ten full service branches, plus West Community Mortgage, in Rock Hill, MO.

Credit Unions Are different than banks.

"$7,107,360 in Direct Financial Benefits" Different!*

America’s Credit Unions estimates that West Community Credit Union provided $7,107,360 in direct financial benefits to its members in 2023, equivalent to approximately $494 per household.

Even better; loyal high-use households received

$1,726 in direct financial benefits!

"West Community Credit Union excels in providing member benefits in many loan and

savings products. In particular, West Community offers lower loan rates on the following

accounts: new car loans, used car loans, personal unsecured loans, first mortgage-fixed rate,

first mortgage-adjustable rate, home equity loans, and credit cards loans. West Community also

pays its members higher dividends on the following accounts: certificate accounts,

IRAs."

—America's Credit Unions

All the banking services you need

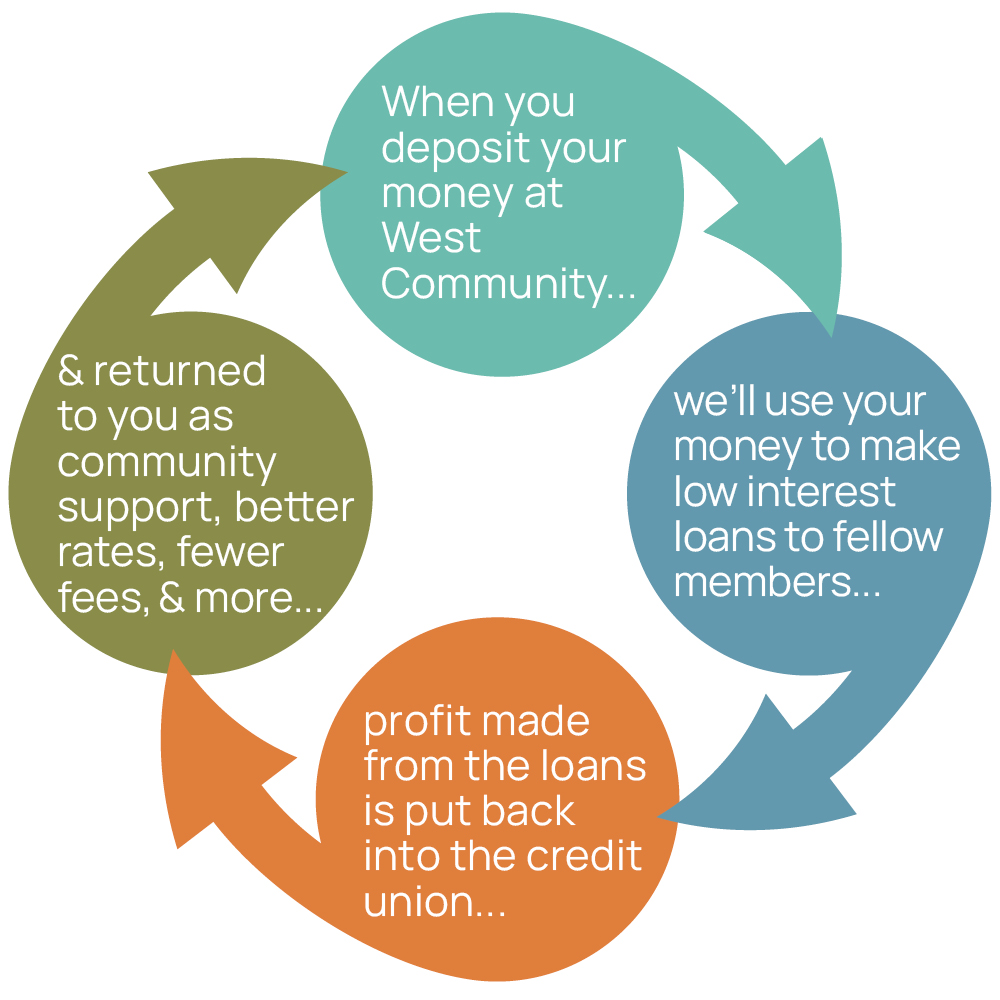

The Difference: West Community Credit Union is owned by our account holders. Our members' financial success is our single goal.

Every traditional bank exists to make their stockholders rich. They achieve this by charging their customers as much as they can get away with in fees and interest, and giving the profits to their stockholders.

Bank customers generally pay more to have basic access to their own money, pay more to borrow, and earn less when they save.

Be an owner. Not a customer.

How We're Governed

West Community is not obligated to make a profit for stockholders–we don’t have any! We are a not-for-profit financial cooperative, exclusively owned and governed by the people who use our financial services.

Our democratically elected, volunteer Board of Directors is comprised of Credit Union member-owners. They work to promote the financial well-being of their fellow members because, when a West Community member succeeds, we all succeed.

That's why cooperative banking is better banking.

The Officers and Directors who serve on the Board, volunteer their time and expertise to establish policies and strategies that will help our financial cooperative grow.

An election is held annually for open positions in which members over 18 years of age can vote. Any member can volunteer to run for the Board of Directors, the Supervisory Committee, or a board committee.

We Serve As Good Stewards of Our Members' Money

Our sound policies and investment practices have helped keep West Community strong, even in times of crisis for other financial institutions. Our products and technological capabilities are among the most secure and advanced available.

Your Deposits Are Insured For a Minimum of $1,000,000

Accounts are federally insured up to $250,000 by the National Credit Union Administration (NCUA). Plus, at West Community we provide an additional $750,000 in private insurance from Excess Share Insurance (ESI). Learn more about your insured funds.

*America's Credit Unions, West Community Member Benefit Report. Rates and fees as of 4/3/2024. Assumes 2.1 credit union members per household. A "loyal member" is assumed to have a $30,000, 60-month new auto loan, a classic credit card with an average balance of $5,000, a $200,000, 30-year fixed rate mortgage (a 30-year fixed rate mortgage is replaced with a 5-year adjustable rate mortgage if it yields a greater benefit as it is assumed more in demand) , $5,000 in an interest-bearing checking account, $10,000 in a one-year certificate account, and $2,500 in a money market account.

BELIEVE IN YOUR DREAMS. WE DO.

At West Community Credit Union, we believe in something bigger. Something that brings us all together. It’s the idea that we’re all connected, and that there’s a common good worth working for. We’re in the business of building relationships based on trust, being honest with our members, and treating everyone fairly.

OUR MISSION: To be our Members' lifelong financial partner by truly understanding their stories and delivering smart solutions.

Life is full of surprises and when something unexpected pops up, we’re always ready to help a

neighbor get back on track. We care about our members and we care about their goals. With smart,

thoughtful solutions, we help our members move forward in life. And we work hard every day to

deliver an exceptional experience for every member, every time.

We believe in people, our

members and our community. We are West Community Credit Union and we are banking on you.

Opening an account is easy!

We make it easy to take advantage of all West Community Credit Union banking has to offer!

If you are affiliated with any of the following, you can open an account:

- Anyone who lives or works in one of these locations:

-

- St. Louis County, MO

- St. Louis, MO

- St. Charles County, MO

-

- Warren County, MO

- Franklin County, MO

- Lincoln County, MO

-

- Boone County, MO

- Jefferson County, MO

- Sikeston, MO

- MIZZOU, Stephens College, and Columbia College students, faculty, staff, alumni, and student organizations

- It's a family thing too! Anyone with a family member* living or working in any of the listed affiliations is eligible to join too. That family member doesn't even have to be a member with us.

Open an Account Today

Open your account online or visit your local branch.

Once a Member, Always a Member

When you join West Community, your $5 initial deposit in a savings account is your share in the Credit Union making you both a member and owner. And once you’re a member, you’re always a member.

Find the branch closest to you and stop by. Our Member Representatives will be happy to help you open an account and start taking advantage of everything cooperative banking has to offer.

*A family affiliation is a parent, legal guardian, spouse, son, daughter, sibling, grandparent, grandchild, nephew, niece, uncle, aunt, first cousin, step, in-law and adoptive relationships.

Membership requires a $5 savings deposit.